Actor intelligence

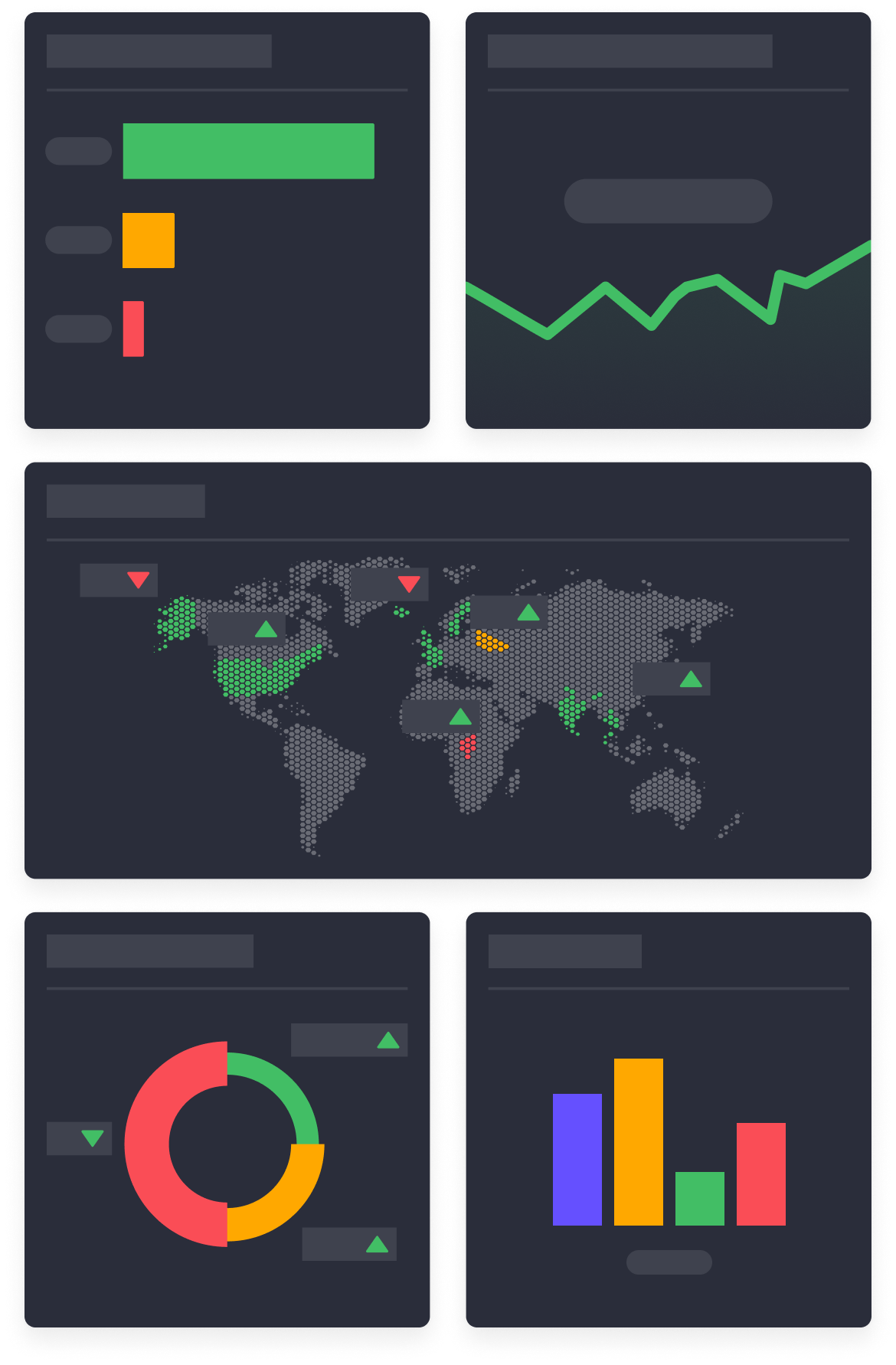

Effortlessly manage risk

Seamlessly explore engaging narratives and visual data for actionable insights. Deep dive into customer accounts, analyze transaction behavior and mitigate risk effortlessly.

- Stay ahead of risk and harness Lucinity's Perpetual KYC and CDD Insights for risk mitigation

- Stay protected and effortlessly assess risk levels in comparison to peer groups and the wider population using Lucinity's intuitive risk matrix

- Leverage multidimensional risk scoring to assess risk from diverse perspectives and uncover deeper insights

Everyone's story is unique

Lucinity helps you make sense of that story. Understand customer information through engaging narratives and compelling data visualizations. Harness the power of generative AI for informed decision-making with ease.

Really understand your customers

Lucinity empowers you to gain deep insights and uncover valuable knowledge about your customers, enabling faster and smarter FinCrime investigations

- Gain a comprehensive view of your customers' profiles and unify KYC data for a complete picture

- Effortlessly decode complex information and intuitively interpret data through visual displays

- Explore granular details with one-click drill-downs, empowering thorough analysis and precise decision-making